News Highlight

The seven-year-old Insolvency and Bankruptcy Code was enacted when over-leveraged companies weighed down India’s banks.

Key Takeaway

- India has proposed over 40 amendments to its insolvency law.

- It might alter how recoveries are distributed among creditors, decriminalise commercial failures, permit the dissolution of empires, and grant the government extra authority in situations of public interest.

- The law had some early success, but litigation delays and pandemic interruptions damaged it.

Insolvency and Bankruptcy Code (IBC)

- About

- Firstly, insolvency occurs when people or businesses cannot fulfil their debts.

- In 2016, the Insolvency and Bankruptcy Code (IBC) was enacted in response to growing non-performing loans.

- In addition, to reform India’s business distress resolution process.

- To integrate current legislation to create a time-bound process based on a creditor-in-control model instead of a debtor-in-possession one.

- Objectives

- All existing insolvency laws in India should be centralised and amended.

- To expedite and explain India’s insolvency and bankruptcy proceedings.

- To protect the firm’s stakeholders/debtors/creditors/employees’ interests.

- Encourage entrepreneurship while also renewing the organisation promptly.

- In India, an insolvency and bankruptcy board will be established.

- Furthermore, to offer critical relief to creditors, thereby enhancing the economy’s credit supply.

Challenges of Insolvency and Bankruptcy Code

- Lack of proper resolution

- According to IBBI data from 3400 instances over the last six years, more than half of the cases ended in liquidation, with only 14% finding a proper conclusion.

- Significant resolution delays

- IBC was initially marketed as a time-bound method.

- The modified IBC act reduced the time required to complete the resolution procedure from 180 days to 330 days.

- Lack of digitisation

- Due to the lack of digitalisation, the insolvency resolution procedure has been delayed beyond the statutory limits.

Insolvency and Bankruptcy Code (Amendment)bill, 2021

- About

- The Bankruptcy and Bankruptcy Code (Amendment) Bill, 2021, was tabled in the Lok Sabha to change insolvency law and create a prepackaged resolution procedure for stressed Micro, Small, and Medium Enterprises.

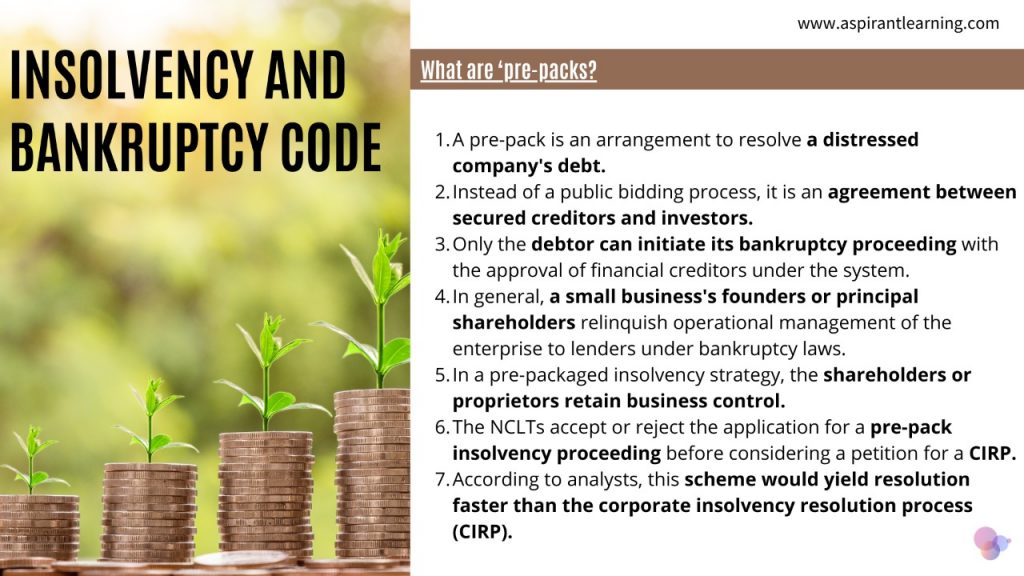

- Additionally, it recommended ‘pre-packs‘ to resolve insolvency for MSMEs.

- Instead of a public bidding process, this mechanism brings key stakeholders such as creditors and shareholders to discover and negotiate with a prospective purchase.

- Provisions of the Bill

- It provides a Rs 1 crore minimum threshold for commencing the pre-packaged insolvency resolution process.

- It allows for determining concurrent petitions for initiating the bankruptcy resolution process and pre-packaged insolvency resolution processes filed against the same corporate debtor.

- Penalty for initiating a pre-packaged insolvency resolution process fraudulently or maliciously with the intent to defraud persons, as well as for fraudulent management of the corporate debtor during the process.

- Furthermore, penalty for offences involving the pre-packaged insolvency resolution process.

Way Forward

- The Parliamentary Standing Committee proposed a schedule of no more than 30 days from filing to admit the insolvency application and transfer management of the company to a resolution procedure.

- A new yardstick for measuring hairstyles: Haircuts, according to the IBBI, should not be viewed as the difference between the creditor’s claims and the actual amount realised.

- Budgetary allocations that are optimal for upskilling insolvency practitioners, enhancing tribunal infrastructure, and digitising the insolvency resolution process.

Pic Courtesy: Deccan Herald

Content Source: Deccan Herald