News Highlights:

- Recently, the Finance Minister of India reported that undisclosed income in unreported foreign accounts crossed ₹15,000 crores.

- The Finance Minister stated that the demand for tax on undisclosed income overseas in the first nine months of the current fiscal slowed to ₹2,098 crore from ₹ 7,055 crores in FY21 and ₹5,350 crores in FY22.

Key Takeaway:

Over the last four years, the Income Tax Department has raised tax demands worth Rs 13,566 crore under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act.

Undisclosed Income:

- About

- Undisclosed income means the income which is not shown by the taxpayer in his income tax return and not paid the taxes on the same. Popularly known as Black Money in India.

- The objective of the Income Tax department is to bring all the undisclosed sources of income into tax.

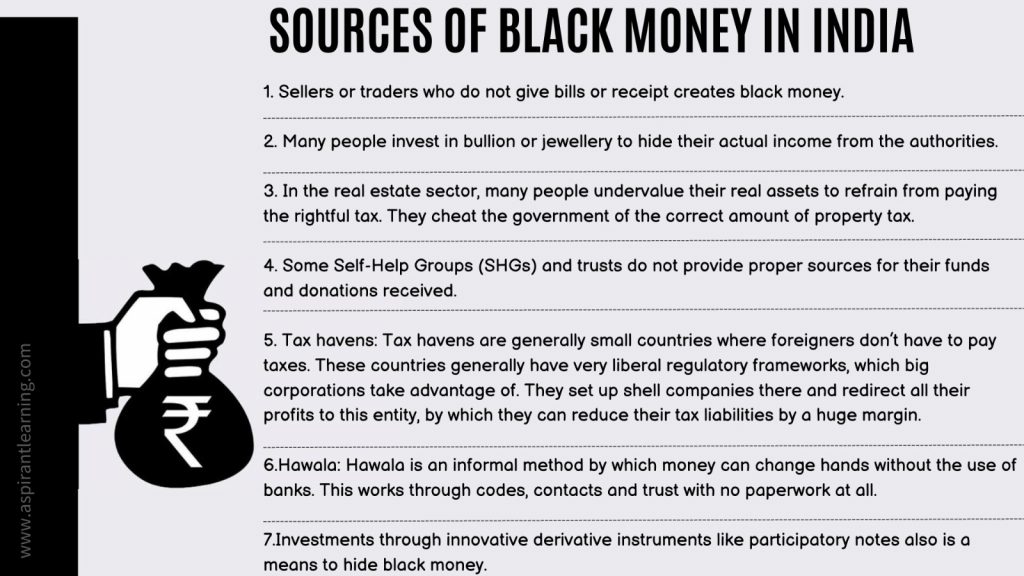

- Undisclosed sources of income:

- Undisclosed sources of income include cash credits, unexplained investments, unexplained money, amounts of investments not fully disclosed in the books of accounts, unexplained expenditure, and the amount borrowed or repaid on hundi.

Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act:

- About:

- Black money in the form of undisclosed foreign income and assets comes under the purview of this law.

- The UFIA Act gives an opportunity to black income holders to reveal black money and pay a tax within a compliance window time.

- After this time, black income holders will come under severe penal and prosecution measures prescribed under the law.

- Objective:

- To create a deterring effect on illegal foreign transactions and bring back undisclosed Indian money abroad.

Features of the Act:

- Applicability:

- The Act will apply to all person resident in India.

- It will also apply to a person being not an ordinary resident or Non-resident but who was an ordinary resident of India during the previous year when undisclosed income was earned or assets acquired outside India.

- Provisions of the Act will apply to both undisclosed foreign income and assets (including financial interest in any entity).

- Tax:

- Undisclosed foreign income or assets shall be taxed at a flat rate of 30 per cent.

- No deductions, exemptions, carry forward, or set-off shall be available while computing tax liability under the Black Money(BM) Act, unlike the Income Tax Act.

- Penalties:

- The penalty for non-disclosure of income or an asset located outside India will be equal to three times the amount of tax payable thereon, i.e., 90 per cent of the undisclosed income or the value of the undisclosed asset.

- This is in addition to the tax payable at 30%.

- There are other penalties also leviable on account of non-disclosure of the required information, and there are prosecution provisions also within the Act.

- One-time compliance opportunity:

- The Act also provides a one-time compliance opportunity for a limited period to persons who have any undisclosed foreign assets that have hitherto not been disclosed for Income-tax purposes.

- Such persons may file a declaration before the specified tax authority within a specified period, followed by payment of tax at the rate of 30 per cent and an equal amount by way of penalty.

- Such persons will not be prosecuted under the stringent provisions of the Act.

Government’s steps for Undisclosed Income:

- Demonetisation:

- The major objectives of announcing demonetisation in India were to stop black money, tax evasion, funding terrorism, and fake money.

- The aim was to reduce counterfeit cash used to fund criminal activities and create a cashless economy.

- The Fugitive Economic Offenders Act, 2018

- The FEO Act was promulgated with the main objective of ensuring that offenders return to India to face prosecution.

- It seeks to confiscate the properties of economic offenders who have left the country to avoid facing criminal prosecution or refuse to return to the country to face prosecution.

- Prevention of Money Laundering Act, 2002

- It aims to prevent and control money laundering.

- To confiscate and seize the property obtained from the laundered money; and. To deal with any other issue connected with money laundering in India.

- The Benami Transactions (Prohibition) Amendment Act, 2016

- The Benami Transactions (Prohibition) Amendment Act, 2016 designed to curb black money was passed by parliament in August 2016 and came into effect in November 2016.

- The new law amended the Benami Transactions Act of 1988 and renamed the same Prohibition of Benami Property Transactions (PBPT) Act of 1988.

Pic Courtesy: Freepik

Content Source: The Hindu