News Highlights:

- Recently, The Central Government suspended the Foreign Contribution Regulation Act (FCRA) licence of the Centre for Policy Research (CPR).

- This came five months after the Income Tax department conducted ‘surveys’ on the premises of the CPR, Oxfam India, and the Independent and Public Spirited Media Foundation (IPSMF), which funds a range of digital media entities.

What is the FCRA?

- About:

- The FCRA was enacted during the Emergency in 1976 in an atmosphere of apprehension that foreign powers were interfering in India’s affairs by pumping funds through independent organisations.

- These concerns had been expressed in Parliament as early as 1969.

- The law sought to regulate foreign donations to individuals and associations so that they functioned “in a manner consistent with the values of a sovereign democratic republic”.

- Objectives:

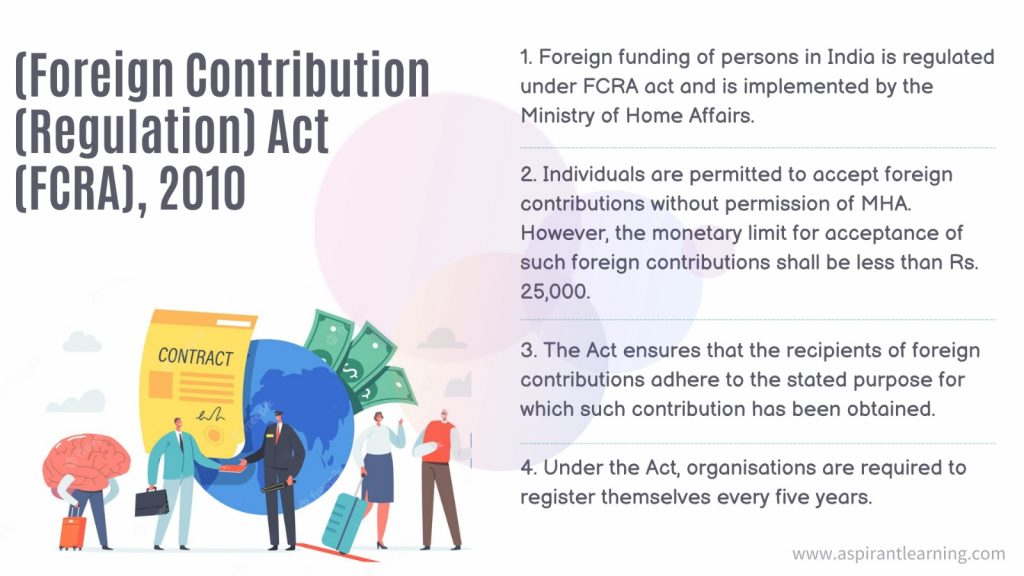

- It requires every person or NGO wishing to receive foreign donations to be registered under the Act, to open a bank account for the receipt of the foreign funds and to utilise those funds only for the purpose for which they have been received and as stipulated in the Act.

- The Act prohibits the receipt of foreign funds by candidates for elections, journalists or newspaper and media broadcast companies, judges and government servants, members of the legislature and political parties or their office-bearers, and organisations of a political nature.

- Amendments:

- It was amended in 2010 to “consolidate the law” on the utilisation of foreign funds and “to prohibit” their use for “any activities detrimental to the national interest”

- The law was amended again by the current government in 2020, giving the government tighter control and scrutiny over the receipt and utilisation of foreign funds by NGOs.

Foreign Contribution (Regulation) Amendment Act, 2020:

- Prohibition to accept foreign Contributions:

- Certain persons are prohibited from accepting any foreign contribution. These include;

- Election candidates, editors or publishers of a newspaper, judges, government servants, members of any legislature, and political parties, among others.

- The Bill adds public servants (as defined under the Indian Penal Code) to this list.

- A public servant includes any person in service, paid by the government, or remunerated by the government for performing any public duty.

- Transfer of foreign Contributions

- Foreign contributions cannot be transferred to any other person unless such person is also registered to accept foreign contributions (or has obtained prior permission under the Act to obtain foreign contributions).

- The Act prohibited the transfer of foreign contributions to any other person. The term ‘person’ under the Act includes an individual, an association, or a registered company.

- Aadhar for registration

- Any person seeking registration (or renewal of such registration) or prior permission for receiving a foreign contribution must make an application to the central government in the prescribed manner.

- The Act adds that any person seeking prior permission, registration or renewal of registration must provide the Aadhar number of all its office bearers, directors or key functionaries as an identification document.

- In the case of a foreigner, they must provide a copy of their passport or the Overseas Citizen of India card for identification.

- FCRA Account

- Foreign contributions must be received only in an account designated by the bank as an “FCRA account” in such a branch of the State Bank of India, New Delhi, as notified by the central government.

- No funds other than the foreign contribution should be received or deposited in this account.

- The person may open another FCRA account in any scheduled bank of their choice for keeping or utilising the received contribution.

- Restriction in utilisation

- The Government may restrict the usage of unutilised foreign contributions for persons who have been granted prior permission to receive such contributions.

- Renewal of licence

- Every person given a registration certificate must renew the certificate within 6 months of expiration.

- The Act provides that the government may inquire before renewing the certificate.

- Reduction in the use for administrative purposes

- A person who receives a foreign contribution must use it only for the purpose it is received.

- They must not use more than 20% of the contribution for meeting administrative expenses (earlier, it was 50%).

- Suspension of Registration

- Earlier governments may suspend the registration of a person for a period not exceeding 180 days.

- The Act adds that such suspension may be extended to 180 days.

- Right to cancel any NGOs

- The Union government reserves the right to cancel any NGO’s FCRA registration if it violates the Act.

- Registration of the NGO can be cancelled for a range of reasons.

- Once the registration is cancelled, it is not eligible for re-registration for three years.

- All orders of the government can be challenged in the High.

Pic Courtesy: Freepik

Content Source: The India Express