News Highlight

New EPFO guidelines help illuminate procedures and required documents for existing employees and those who have retired after September 1, 2014.

Key Takeaway

- The Employees’ Provident Fund Organisation (EPFO) has set new guidelines for employees and pensioners for higher pensions.

- The new guidelines allow employees to deduct a sum equal to 8.33% of the actual basic salary towards the EPS.

- Actual basic pay is Basic pay + DA

- It helps to accumulate a larger corpus and receive a higher pension amount.

Employees’ Provident Fund Organization (EPFO)

- About

- It is a statutory body formed under the Employees’ Provident Fund and Miscellaneous Provisions Act 1952.

- The Act’s Schemes are overseen by a tri-partite Board known as the Central Board of Trustees.

- It comprises representatives from:

- The Government (Central and State)

- Employers

- Workers

- In addition, the EPFO assists the Board.

- It is managed by the Government of India’s Ministry of Labour and Employment.

- Regarding customers and the volume of financial transactions handled.

- Furthermore, it is one of the world’s largest enterprises.

- Features

- EPF i Grievance Management System (EPFiGMS) is a bespoke EPFO platform designed to remedy issues about EPFO services.

- Grievances can be submitted at any time and will be directed to the appropriate office.

- In addition, it also oversees social security treaties with other countries.

- In nations where bilateral agreements have been made, international workers are protected by EPFO plans.

- To enable Provident Fund number portability, the Government of India launched a Universal Account Number for EPFO employees.

- Furthermore, a 12-digit number is assigned to employees who contributed to EPF and generated by EPFO for each PF member.

Schemes Offered Under the EPFO

- Employees Provident Funds Scheme 1952 (EPF)

- Employees’ Pension Scheme 1995 (EPS)

- Employees’ Deposit Linked Insurance Scheme 1976 (EDLI)

Employee Provident Fund (EPF)

- Eligibility

- Salaried employees earning less than Rs.15,000 per month must enrol for an EPF account.

- According to the law, an organisation with over 20 employees must register for the EPF system.

- Organizations with fewer than 20 employees can also voluntarily join the EPF plan.

- Workers earning more than Rs.15,000 can also open an EPF account.

- However, they must first obtain permission from the Assistant PF Commissioner.

- Furthermore, the EPF system’s provisions are available to India’s entire country.

- Except for the state of Jammu and Kashmir.

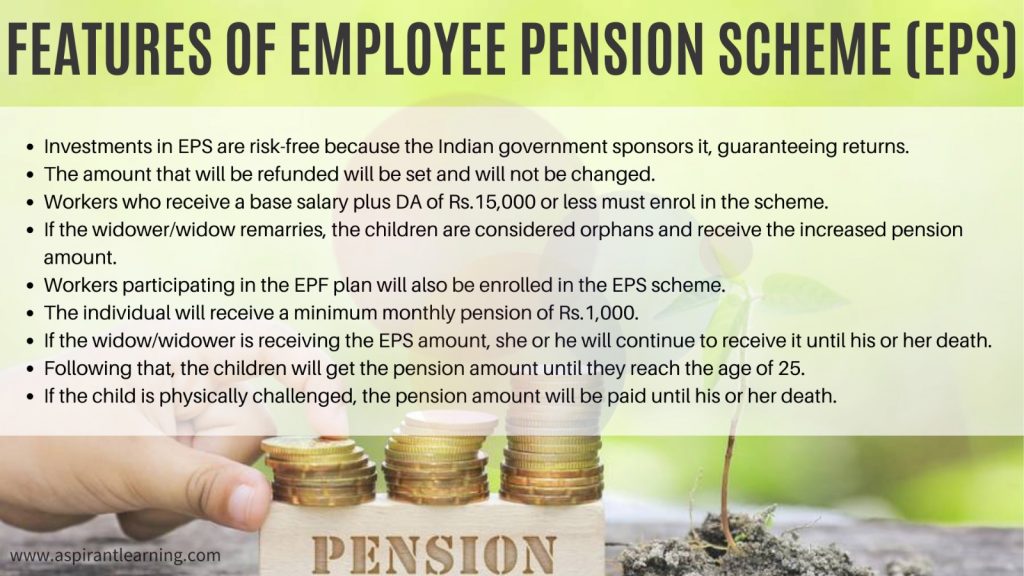

Employee Pension Scheme (EPS)

- Eligibility

- You must be an EPFO member.

- For an early pension, you must be 50 years old.

- In addition, for a regular pension, you must be 58.

- If you postpone your pension for two years (until you reach the age of 60).

- Additionally, you will be able to receive an additional 4% every year.

- At least ten years of service are required.

Pic Courtesy: The Hindu

Content Source: The Hindu