News Highlight

The RBI has approved opening nine special vostro accounts in two Indian banks to settle rupee payments for trade between India and Russia.

Key Takeaway

- According to government officials, 20 Russian banks, including Rosbank, Tinkoff Bank, Centro Credit Bank, and Credit Bank of Moscow, have launched Special Rupee Vostro Accounts (SRVA) with Indian partner banks.

- Under the system, all major domestic banks have designated nodal officials to resolve concerns encountered by exporters.

Nostro Accounts

- About

- A Nostro account is a bank’s account in another bank.

- It enables consumers to deposit funds into a bank’s account at another bank.

- It is frequently used when a bank has no branches in a foreign country.

- Nostro is a Latin word that means “ours”.

- Assume bank “A” has no branches in Russia, although bank “B” does.

- “A” will now open a Nostro account with “B” to receive the deposits in Russia.

- Now, if any consumers in Russia wish to send money to “A”, they can deposit it into A’s account in “B”.

- “B” will pay “A” the money.

- The major distinction between a deposit account and a Nostro account is that private depositors own the former, whereas the latter is held by foreign entities.

Vostro Accounts

- About

- Vostro means “yours” in Latin.

- For the bank that opens the account, a Nostro account is a Vostro account.

- The account will be known as a Vostro account for bank “B” in the preceding example.

- The Vostro account accepts payments on behalf of the account holder’s bank.

- When money is deposited in a Vostro account is transferred to the account holder’s bank.

- Nostro and Vostro accounts are held in foreign currency.

- Vostro accounts enable domestic banks to offer international financial services to their clients who require them.

- Vostro account services include wire transfers, foreign exchange transactions, deposit and withdrawal capabilities, and international trade streamlining.

Advantages of Vostro and Nostro Accounts

- They aid in the execution of major foreign exchange transactions when there is no physical presence in other countries.

- They allow banks to hold funds in foreign currency without the danger of exchange rate fluctuations.

- It is simple because it is simply a transfer of funds from one bank account to another.

Disadvantages of Vostro and Nostro Accounts

- A lower interest rate than a savings or current account.

- It is often more expensive because it is a service the home bank gives to facilitate the execution of foreign exchange transactions.

- The operation of these accounts is subject to stringent restrictions and laws.

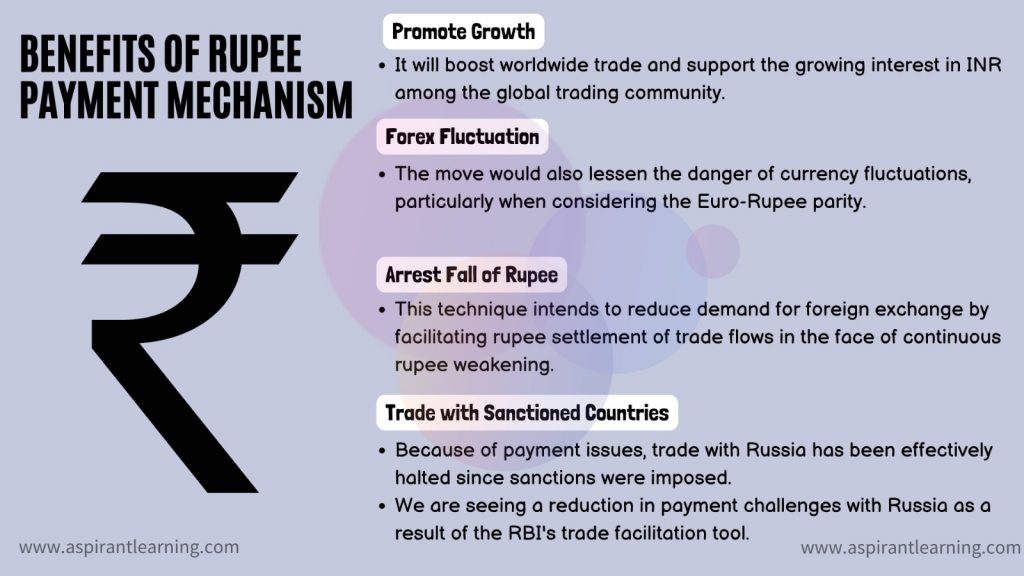

Rupee Payment Mechanism

- About

- Authorized Dealer Banks in India might now open Rupee Vostro Accounts.

- Indian importers using this system will pay in INR.

- It will be credited to the Special Vostro account of the partner country’s correspondent bank.

- It is against the bills from the overseas seller for the supply of goods or services.

- Indian exporters who use the method will be paid in INR from the balances in the specified Special Vostro account of the partner country’s correspondent bank.

- Via the Rupee mentioned above Payment Mechanism, Indian exporters may get advance payment in Indian rupees from overseas importers for exports.

Pic Courtesy: The Hindu

Content Source: The Hindu