News Highlight

New foreign trade policy 2023 aims at tripling goods and services exports by 2030; apart from a one-time amnesty, no significant schemes have been announced.

Key Takeaway

- The Union Ministry of Commerce, Industry, and Textiles revealed a new Foreign Trade Policy that shifted away from offering exporters incentives.

- Nonetheless, it cuts a few fees for smaller businesses, offers faster clearances, and a one-time amnesty scheme for export obligation defaults.

- The new policy will take effect in 2023-24, replacing the previous policy of 2015.

- It seeks to nearly quadruple India’s products and services exports to $2 trillion by 2030, up from $760 billion in 2022-23.

Foreign Trade Policy (FTP) 2023

- Overview

- FTP will ensure policy continuity and a responsive framework.

- Introduces a plan to decrease tariffs, taxes, and government charges on export commodities.

- Digitisation of FTP-related programmes.

- The system automatically approves FTP applications.

- A pilot programme was launched to reduce the processing time of applications for advance authorisation to one day.

- Recognition standards for Star Trade Houses were relaxed.

- Encourages transactions in Indian rupees.

- Introduces provisions for commercial trading.

- A notably advanced authorisation mechanism has been extended to the garment and clothing sector.

- All FTP benefits are extended to e-commerce exports.

- The value limit for courier exports has been raised from Rs 5 lakh to Rs 10 lakh per shipment.

- Through the Districts as Export Hubs project, focus on interacting with states and districts.

- FTP must be dynamic and adaptable to changing trading conditions.

- The Department of Commerce is being restructured to make it more future-ready.

Key highlights of the Policy

- Process Re-Engineering and Automation

- The strategy stresses export promotion and development, shifting from an incentive regime to a facilitating power.

- It is based on technology interface and collaborative principles.

- Fee reductions and IT-based programmes will make accessing export benefits easier for MSMEs and others.

- Duty exemption programmes for export manufacturing will now be implemented via Regional Offices in a rule-based IT system environment, removing the requirement for a manual interface.

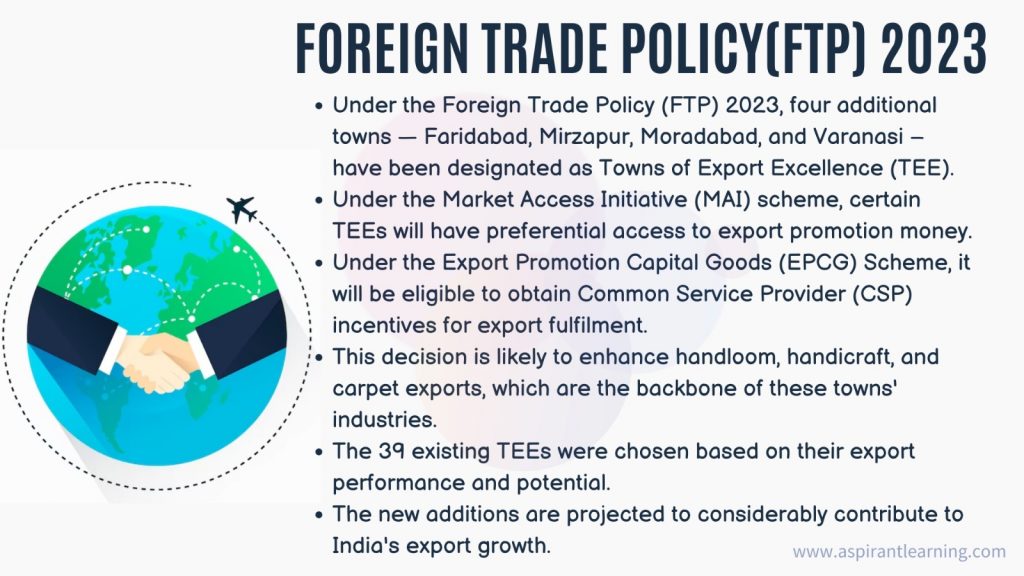

- Towns of Export Excellence

- In addition to the existing 39 towns, four new towns have been certified as Towns of Export Excellence (TEE).

- TEEs would be given priority for export promotion financing under the Market Access Initiative (MAI) Programme.

- Under the EPCG Scheme, it can obtain Common Service Provider (CSP) benefits for export fulfilment.

- Promoting Export from the Districts

- The FTP intends to forge alliances with state governments and to advance the Districts as Export Hubs (DEH) project.

- This would boost district-level exports and hasten the development of the grassroots trading ecosystem.

- Streamlining SCOMET Policy

- India is emphasising the regime of “export control.”

- India’s strong export control regime would allow access to high-end dual-use commodities.

- Technology to Indian exporters while permitting the export of prohibited items/technologies from India under SCOMET.

- Amnesty Scheme

- Under the FTP 2023, the government is implementing a unique one-time Amnesty Program to resolve defaults on Export Obligations.

- Furthermore, relief is being provided to exporters unable to meet their duties under EPCG and Advance Authorisations.

- With the payment of all customs duties, all pending cases of failure to meet Export Obligation (EO) of authorisations can be regularized.

- They were exempted according to the number of unfulfilled export obligations.

- Under this system, the interest payable is limited to 100% of the exempted duties.

- Additionally, no interest is charged on the Additional Customs Duty and Special Additional Customs Duty part.

Way forward

- The new FTP focuses more on addressing operational concerns in EXIM operations.

- It reduces the cost of doing business and enhances company-level export competitiveness.

- To enable a mechanism for integrated tax neutralisation via a single point of contact.

- They are reducing logistical costs to make products more competitive.

- Digitisation and e-commerce must complement and integrate government programmes such as one district and product.

- Free trade agreements amongst regional partners should be pursued further to capitalise on trade prospects with leading economies.

Pic Courtesy: DNA India

Content Source: The Hindu