News Highlights:

The Goods and Services Tax (GST) Council, in its 49th meeting, accepted the Group of Ministers (GoM) recommendations on the creation of the GST Appellate Tribunal in the country.

Key Recommendations:

- The Goods and Services Tax (GST) Appellate Tribunal is likely to be headed by a former Supreme Court judge or a former Chief Justice of a High Court.

- There will be one principal bench of the Appellate Tribunal in New Delhi and several State benches.

- According to the norms endorsed by the GST Council, appeals pertaining to disputes of less than Rs 50 lakh that doesn’t deal with a question of law could be decided by a single-member bench.

- Currently, taxpayers are filing writ petitions to directly move the High Court.

- Establishing an Appellate tribunal would result in a lower burden on the courts and taxpayers.

Appellate Tribunal under GST:

- Overview:

- The Appellate Tribunal under GST is a quasi-judicial body that has been established to provide a platform for the resolution of disputes that arise between businesses, individuals, and the government regarding the implementation and interpretation of the GST laws.

- The Tribunal operates as an appellate authority that hears appeals against the decisions and orders of the lower authorities.

- Under GST, if a person is not satisfied with the decision passed by any lower court, an appeal can be raised to a higher court; the hierarchy for the same is as follows (from low to high):

- Adjudicating Authority

- Appellate Authority

- Appellate Tribunal

- High Court

- Supreme Court.

- About GST Appellate Tribunal:

- Section (109) of the Goods and Service Tax Act, 2017 (CGST Act) mandates the constitution of a GST Appellate Tribunal (GSTAT) and its Benches.

- The GST Appellate Tribunal (GSTAT) is a specialised authority to resolve disputes related to GST laws at the appellate level.

- Composition:

- The GST Tribunal will have one principal bench in New Delhi and as many benches or boards in states as decided by each state, subject to the council’s approval.

- North-eastern states could opt for one bench for 2-3 states and another for far-flung areas.

- The principal bench and state boards would have two technical and two judicial members each, with equal representation from the Centre and states.

- All four members would not sit for a hearing in each case. It depends on the threshold or value of the dues involved.

- Powers of the Appellate Tribunal:

- As per the Code of Civil Procedure, 1908, the GST Appellate Tribunal holds the same powers as the court and is deemed Civil Court for trying a case.

- The Appellate Tribunal has been granted the powers to hear appeals and to pass orders and directions, including those for the recovery of amounts due, to enforce its orders, and to rectify mistakes.

- The Tribunal also has the power to impose penalties, revoke or cancel registrations, and take other measures necessary to ensure compliance with the GST laws.

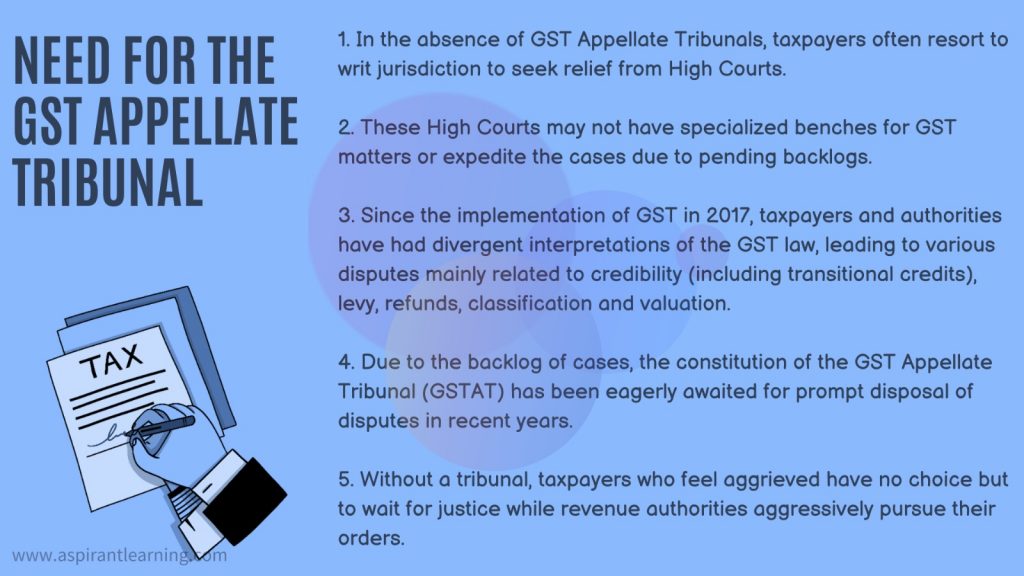

Benefits of GST Appellate Tribunal:

- Adaptable:

- GST Appellate Tribunal (GSTAT) is more adaptable and economical than regular courts, providing quick justice.

- Its procedures are simple enough for a layperson to understand, making it one of the most popular Alternative Dispute Resolution options.

- Reduce conflicts:

- GSTAT will assist both the Union and State Governments in reducing conflicts between them and ensuring uniformity in dispute resolution.

- Simple taxation:

- GST was designed with the goal of One Nation, One Tax to make taxation simple for citizens to comply with.

- The establishment of GSTAT aims to institutionalise the government’s citizen-centric approach to taxation.

- Business-friendly:

- The creation of GSTAT will signal to the world that India is taking steps to make the country more business-friendly and a preferred destination for trade and commerce.

- Establishing GSTAT is expected to bring relief to businesses by providing a quick and efficient process for resolving GST disputes.

- Establishing GSTAT will facilitate the “ease of doing business” and make India a more lucrative destination for trade.

- Speedy resolution of disputes:

- An appropriate appellate structure in the form of GSTAT will provide an effective and speedy resolution of disputes, thereby reducing the burden on the judiciary.

Pic Courtesy: Freepik

Content Source: The Hindu