News Highlight

Reserve Bank of India’s new pilot project on coin vending machines.

Key Takeaway

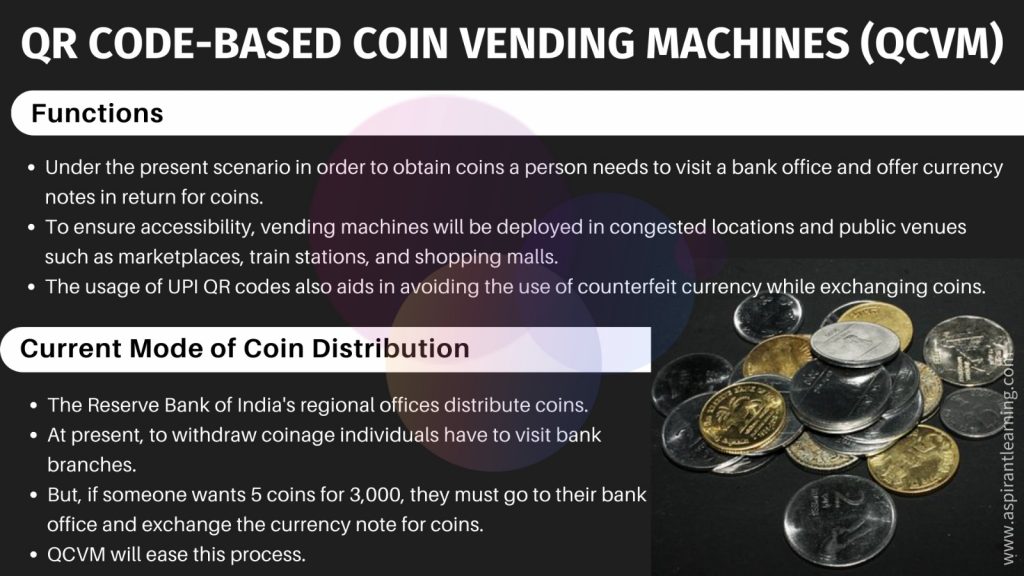

- RBI Governor had remarked during the recent Monetary Policy Committee (MPC) address that the apex financial regulator, in partnership with banks.

- It would undertake a pilot project to evaluate the operation of a coin vending machine based on QR codes.

QR code-based Coin Vending Machine (QCVM)

- About

- A person will have to approach the bank branch to withdraw coins.

- The QR code-based coin vending machine (QCVM) is designed to dispense coins like currency notes that can be withdrawn from ATMs.

- Coins can be withdrawn from vending machines with the Unified Payments Interface (UPI) QR code.

- Coins in denominations ranging from Rs 1 to Rs 20 will be available in QCVM.

- Furthermore, the RBI intends to offer the product in 19 venues across 12 cities.

- Because the implementation would begin with a pilot launch, just a few banks may be involved in the early phases.

Advantages of QCVM

- The main goal is to improve cash availability at the last mile across all categories, including the mass market.

- Because the interface is UPI, linked to the person’s bank account, the value of coins withdrawn is directly debited from the bank account.

- It eliminates the need to exchange notes for coins, saving time for bank branches and customers.

- In addition, that will improve coin accessibility.

- With cash sales still essential at tiny shops, QCVM could help vendors when coins are scarce.

Disadvantages of QCVM

- Banks may incur additional fees for replenishing these vending machines through third-party agents.

- A coin costs Rs 1.11 on average to mint.

- From a financial standpoint, adding another layer for setting up and distributing currency through vending machines could be more appealing.

- Because the government’s goal is to increase the popularity and reach of digital payments, QCVM may be detrimental.

- QCVM appears to oppose e-Rupee retail’s goal.

- It is to lower currency minting/printing costs and gradually replace physical currencies with digital currencies.

Unified Payments Interface (UPI)

- About

- It is a more advanced form of Immediate Payment Service (IMPS), a 24-hour funds transfer service designed to make cashless payments faster, easier, and more seamless.

- UPI is a system that integrates;

- Several bank accounts into a single mobile app (of any participating bank)

- Combining several banking features

- Smooth fund routing

- Merchant payments are under one umbrella.

- UPI is now the most popular of the National Payments Corporation of India (NPCI)-managed systems, which also include;

- The National Automated Clearing House (NACH)

- Immediate Payment Service (IMPS)

- Aadhaar-enabled Payment System (AePS)

- Bharat Bill Payment System (BBPS)

- RuPay and others.

- Today’s top UPI apps include PhonePe, Paytm, Google Pay, Amazon Pay and BHIM, the latter being the Government offering.

- As part of an arrangement, India’s UPI would be linked to Singapore’s PayNow.

- In 2016, NPCI launched UPI with 21 member banks.

National Payment Corporation of India (NPCI)

- About

- NPCI is an umbrella corporation operating retail payment settlement services in India.

- The RBI and the Indian Banks’ Association (IBA) founded NPCI under the Payment and Settlement Systems Act of 2007.

- In addition, it is to create a substantial Payment and Settlement Infrastructure in India.

- Under the Companies Act of 1956, NPCI was established as a non-profit organisation (Now the Companies Act of 2013).

- Functions

- NPCI handles all retail payments in India.

- The RuPay card network, India’s domestic card network, is operated by NPCI.

- The Universal Payments Interface (UPI) is a real-time payment system that enables rapid payments between bank accounts.

- NPCI acts as National Automated Clearing House (NACH), an offline web-based system that handles bulk push and pulls transactions.

- NACH provides an electronic mandate platform for corporates and banks to register mandates, allowing paperless collection operations.

- It supports both account and Aadhaar-based transactions.

- Furthermore, NPCI manages the National Financial Switch (NFS).

Pic Courtesy: The Hindu

Content Source: The Hindu