News Highlights

Economists expect the Centre to raise the interest rates paid on Small Savings Scheme for the July to September 2022 quarter.

Focus Points

- The rates of interest on instruments such as the Public Provident Fund (PPF) and the National Savings Certificate (NSC), currently at 7.1% and 6.8%, respectively, have not been changed for eight quarters

Reason for expectation of rate hikes

- Interest rates on small savings instruments (SSIs) expected to be increased, due to the sharp rise in the G-Sec yields of various maturities, to which such rates are linked.

What are Small Savings Scheme?

- Small Savings Schemes are a set of savings instruments managed by the central government with an aim to encourage citizens to save regularly irrespective of their age.

- They are popular as they not only provide returns that are generally higher than bank fixed deposits but also come with a sovereign guarantee and tax benefits.

Who fixes the interest rate?

- Since 2016, the Finance Ministry has been reviewing the interest rates on small savings schemes on a quarterly basis in line with the movement in benchmark government bonds of similar maturity.

How are rates decided?

- Interest rates on small savings schemes are reviewed by the Government every quarter, with reference to traded yield levels (interest rates) of Government Securities in the secondary market.

- There are set formulae for mark-ups over the traded levels of Government bonds.

- The rationale for linking it to G-Sec yields in the secondary market is that it is in line with interest rate movements.

- G-Sec yield movements reflect the actual and anticipated events in the economy pertaining to interest rates.

Where the money got deposited?

- All deposits received under various small savings schemes are pooled in the National Small Savings Fund. The money in the fund is used by the central government to finance its fiscal deficit.

Types of Small Savings Scheme

- The schemes can be grouped under three heads – Post office deposits, savings certificates and social security schemes.

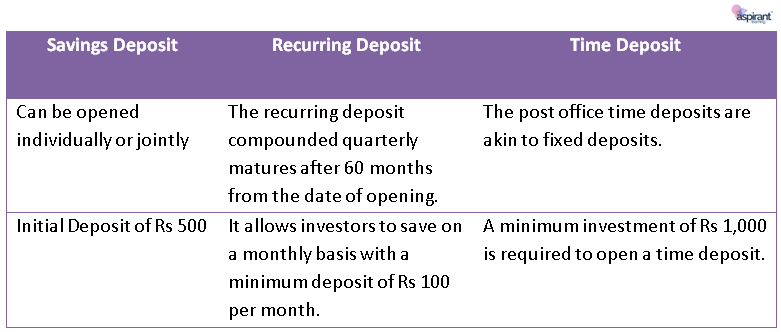

- Post office deposits

- Under Post Office Deposits we have the savings deposit, recurring deposit and time deposits with 1, 2, 3 and 5 year maturities and the monthly income account.

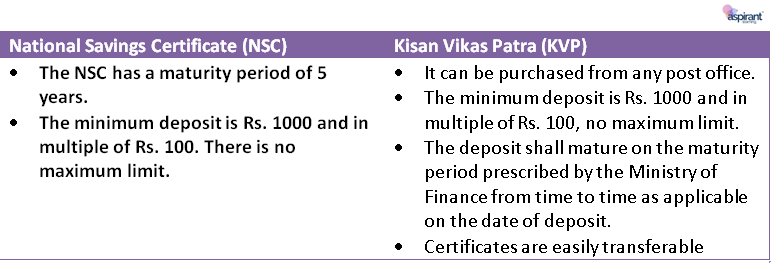

- Savings Certificates

- Under Savings Certificates, we have the National Savings Certificate and the Kisan Vikas Patra.

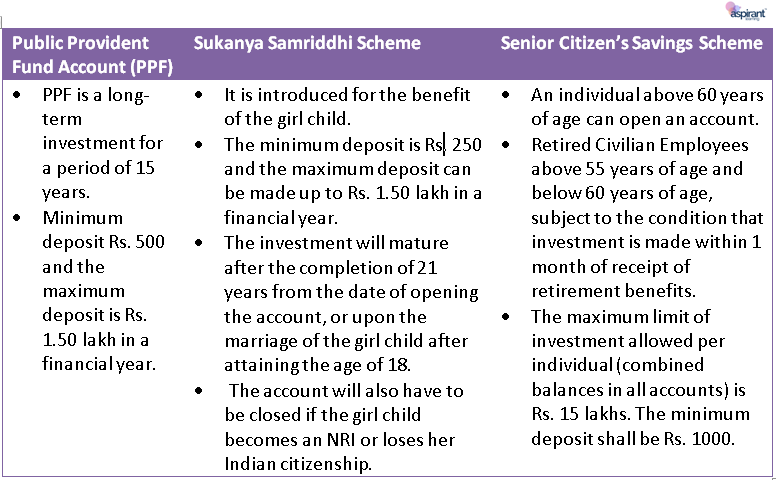

- Social security schemes

- In social security schemes, there is Public Provident Fund, Sukanya Samriddhi Account and Senior Citizens Savings Scheme.

Pic Courtesy: Business Standard

Content Source: The Hindu