News Highlights

The Home and Cooperation Minister assured the Urban Cooperative Banks and credit societies that the government would not allow any ‘second grade citizen’ treatment to them when it comes to RBI norms or other government policies under the recently amended Banking Regulation Act.

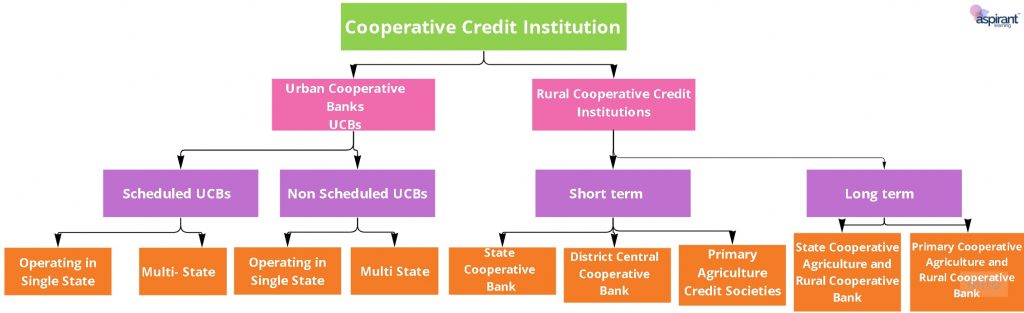

What are Urban Cooperative Banks

- The Urban Co-operative Banks (UCBs) usually refers to primary co-operative banks operating in urban and semi-urban areas.

- These banks primarily lent to small borrowers and businesses centred on communities,

Background of Urban Cooperative Banks

- They started in India close to the end of nineteenth century

- They were based on the principles of co-operation, democratic decision making, mutual help and open membership.

- Till 1996: Allowed to lend money for non-agricultural purposes only

- 1949: Real impetus and proliferation in the sector began after this sector was brought under the purview of Banking Regulation Act

- The evolution of the sector may be categorised into three phases: Growth phase, Crisis phase and Consolidation phase.

Growth Phase of UCB’s (1966-2000)

- 1992: Marathe Committee had come out with recommendations primarily aimed at removal of ‘fetters’ on UCBs’ freedom– RBI accepted most of them

- 1993: repeal of the existing “one-district, one-bank” policy

- After the RBI’s liberalisation of bank licensing policy s 823 new UCB’s were formed

Crisis Phase (2001-2008):

- 2001: Madhavpura Mercantile Cooperative Bank Scam happened

- 2004-05: RBI introduces comprehensive policy on UCBs, that covers an appropriate legal & regulatory framework for the urban banking sector, it would think of issuing fresh licenses.

- As such no fresh licence was issued henceforth for opening the new UCB

- After that UCB’s number decrease steadily

- This phase also seen the voluntary consolidation in the urban banking sector by merger of a few non-viable UCBs with well-managed and financially sound UCBs.

Consolidation Phase (2008 onwards):

- 2008-2013: various new and innovative initiatives and consistent efforts by RBI, there was a drop in the number of financially weak urban cooperative banks

- RBI has set up the Malegam Committee in 2010 for studying the scope for granting new licenses to start urban co-operative banks.

- The Committee has given it‟s suggestion that the pre-existing well-managed co-operative credit societies that fulfill the prescribed financial criteria, be given top priority for granting of licenses.

Dual Regulation of Urban Cooperative Banks

- UCBs registered as co-operative societies under the Co-operative Societies laws of Centre or States.

- They also regulated by RBI since 1966 when some of the provisions of the BR Act extended to UCBs.

- RBI under the provisions of BR Act regulated Banking related functions of UCB

- Powers with regard to incorporation, management, audit and winding up continued to be governed by the co-operative societies acts concerned.

- Over the years RBI had taken non-legislative measures to mitigate some of the conflicts created by this system of duality

- Forum of Task Force for Urban Co-operative Banks (TAFCUB) set up for each state with representations from RBI, the concerned government and the UCB sector representatives

- Later Banking Regulation (Amendment) Act, 2020

- Brought management / governance, audit, reconstructions / amalgamation, winding up, etc. of co-operative banks under RBI’s purview

Challenges faced by Urban Cooperative Banks

- Failures of cooperative banks

- Cooperative banks in India have been struggling to survive for the last few years.

- The issue came into the limelight after the Punjab and Maharashtra Cooperative (PMC) bank fiasco, which left frantic depositors visiting the branches in attempts to withdraw their hard-earned money.

- Challenging Changes:

- The evolving changes in the financial sector combining and integrating micro finance, FinTech companies, payment gateways, social platforms, e-commerce companies and NBFCs

- Which challenges the continued presence of the UCBs, which are mostly small in size, lack professional management and have geographically less diversified operations.

- Balance sheet issues

- Sharper decline is seen both in terms of loans and deposits.

- Large share of Rural cooperatives:

- They make up 65% of the total size of all cooperatives taken together.

- Declining number of UCBs:

- After liberalisation in licensing policy in 1993, nearly one-third of the newly licensed ones became financially unsound

- Frauds, COVID etc affected the asset quality:

- This, even, resulted in the decline of profitability of Urban Cooperative Banks.

Major Initiatives taken to Development of UCB’s

- The RBI revised the Supervisory Action Framework (SAF) for UCBs in January 2020.

- The Central Government approved an Ordinance in June 2020 that will bring all urban and multi-state cooperative banks under the direct supervision of the RBI.

- 2021: RBI constituted Expert Committee on Primary (Urban) Co-operative Banks under the chairmanship of N S Vishwanathan, former RBI Deputy Governor. Recommendations of the committee

- Four-tier structure for the urban cooperative banks (UCBs) based on the deposits and prescribed different capital adequacy and regulatory norms

- Tier-1: UCB with deposits up to Rs 100 crore;

- Tier-2: UCB with deposits between Rs 100-Rs 1,000 crore,

- Tier-3: UCB with deposits between Rs 1,000 crore to Rs 10,000

- Tier-4: UCB with deposits of over Rs 10,000 crore.

- Four-tier structure for the urban cooperative banks (UCBs) based on the deposits and prescribed different capital adequacy and regulatory norms

- It suggested that the minimum Capital to Risk-Weighted Assets Ratio (CRAR) for these UCBs could vary from 9 per cent to 15 per cent and for Tier-4 UCBs the Basel III prescribed norms.

- It prescribed separate ceilings for home loans, loans against gold ornaments and unsecured loans for different categories of UCBs

Way Forward

- Urban Co-operative banking sector occupies a formidable place in Indian banking system.

- It has gone through a lot of turmoil over the years and with a series of regulatory measures undertaken by RBI and after implementation of recommendations of various committees, the sector is looking forward with a positive note in respect of various parameters to regain the confidence of common man and to fulfill the objectives of it‟s Origin.

Pic Courtesy: The Financial Expresss

Content Source: Indian Express