News Highlights

RBI set new norms for large non-banking financial companies (NBFCs) in the wake of the role played by them in retail lending.

RBI Norms for Non-Banking Financial Companies (NBFCs)

- Standard Assets

- Previous One

- The RBI introduced provisioning for standard assets after 2011 and by March 2015, the provisioning needed to be 0.25% of outstanding assets.

- Currently, systemically important NBFCs make standard asset provision at a flat rate of 0.4%.

- New One

- According to the regulations, NBFCs will need to make provision of 2% on standard assets for housing loans disbursed at teaser rates.

- The RBI has issued the rules on standard asset provisioning as part of the framework for scale-based regulation for NBFCs.

- Previous One

- Teaser Loans

- Teaser loans attract lower interest rates in initial years after which rates are reset higher.

- The rate of provisioning will decline to 0.4% after a year from the date on which the rates are reset.

- Commercial Real Estate Loans

- For commercial real estate loans for projects other than residential ones, provisions on standard assets have been set at 1% of the outstanding amount.

- Loans disbursed for office buildings, retail space, multi-purpose commercial premises, industrial or warehouse space, hotels or land acquisition will fall under this category.

- Loans for which the recovery in the case of a default will depend on cash flows arising from such properties will also be included under this category.

- The rate of provision for commercial real estate loans for residential housing stands at 0.75% of the outstanding amount.

- For projects which have commercial and residential parts, the commercial area must be less than 10% of the total floor space index (FSI).

- Individual housing loans and loans to small and micro enterprises

- For all individual housing loans and loans to small and micro enterprises (SMEs), such NBFCs will have to make provision of 0.25% for standard assets.

- Other Loans

- For all other loans, the rate of provision is 0.4% of the outstanding amount.

Non Banking Financial Companies (NBFC)

- Related Act – Companies Act,2013

- Control by – Ministry of Corporate Affairs and the RBI

- Restricted Activities

- It is unable to receive public deposits because it does not enable individuals to create savings or current accounts with it.

- In addition, an NBFC cannot issue checks or draughts drawn on itself.

- Allowed Activities

- NBFCs can accept deposits in one big payment or on a recurring basis under any arrangement or strategy.

- NBFCs are microfinance institutions that provide credit and loans.

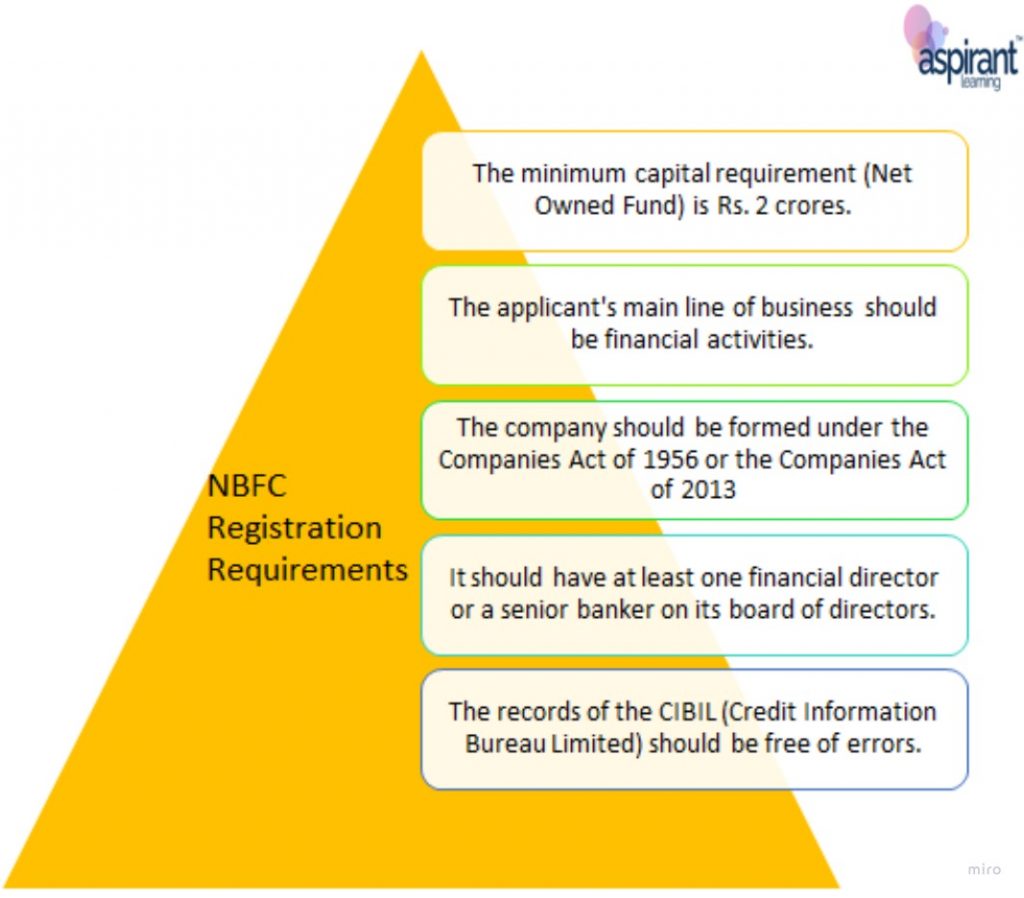

- NBFC Registration Requirements

Content Source : Indian Express