News Highlights

The government is taking steps to address the issues of gig economy related workers through a training program.

About Training Program for Government Officials on Labour Rights Security

- Areas of Focus in the Training

- On technological change, new forms of employment, working conditions and mechanisms to protect labour and social security rights of these workers

- Who Organises a Training Program ?

- The V.V. Giri Institute, the training arm of the Union Labour Ministry, is organising the programme aimed at sharing information and good experiences on policies and global practices relating to gig and platform workers and their social security

- Need of Program

- Concerned at the lack of job and social security among gig and platform workers.

- The workers employed with many new platforms had been protesting and striking work demanding proper wages and social security.

- Areas of Discussion

- The three day programme will discuss the mechanisms to be evolved on the proposed Social Security Fund for unorganised workers, gig workers and platform workers and how the registration of these platform workers could be completed through the e -Shram portal.

- Trade unions and employers’ organisations have also been invited to the session.

- Experiences and interventions of Australia, New Zealand, China, Thailand and Malaysia in this sector will be discussed in the sessions.

- Examples such as social security for platform workers in the transport sector of Thailand and Malaysia, where there are online models under which 2% for every ride is deducted for health and accident insurance and for social security will be taken up during the session

- The session also considered the employer employee relationship in the context of the gig economy.

- Workers’ employment relationships are not recognised in law in this case and gig workers are largely excluded from labour and social security rights, both in terms of law and in practice.

About Gig Economy

- A Gig economy is a free market system in which organizations hire independent employees for short-term assignments.

Potential of India’s Gig Sector

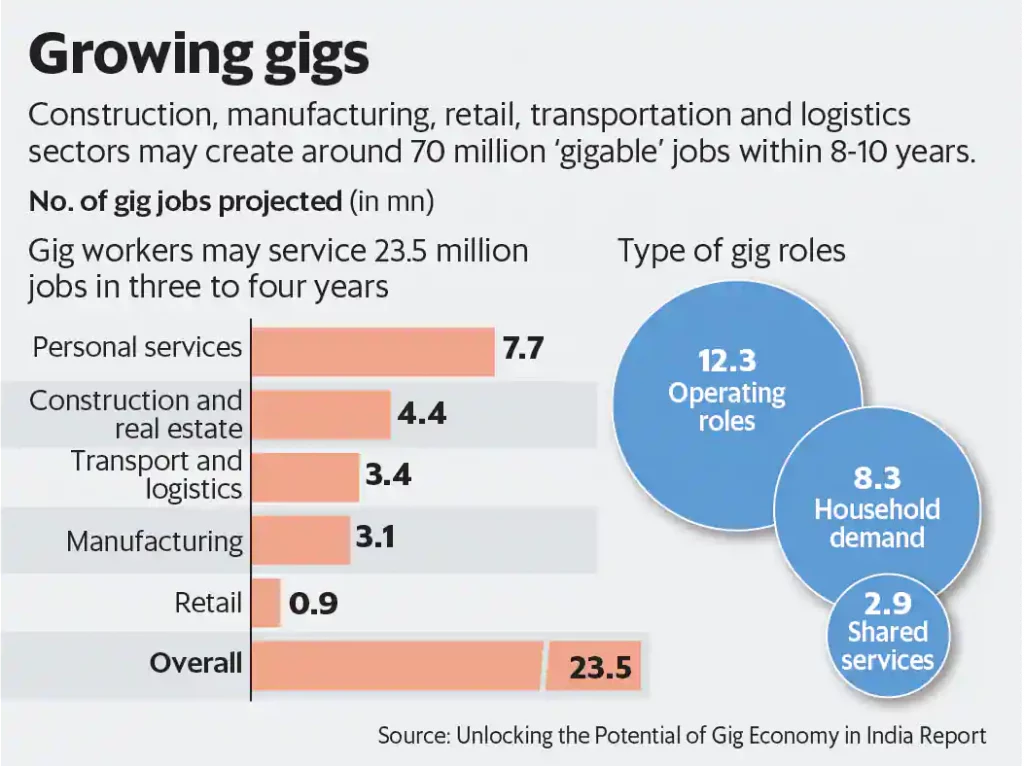

- Gig economy enterprises are responsible for 56 percent of new employment in India, which includes both blue-collar and white-collar workers.

- India was listed among the top ten countries in the Global Gig Economy Index study. India accounts for almost 40% of all freelancing work available worldwide.

- In India, the gig economy has the potential to create up to 90 million employment in non-farm industries, adding 1.25 percent to GDP over the long term.

- The gig economy will be a crucial building element in bridging the income and unemployment divide as India strives to become a USD 5 trillion economy by 2025.

Why Gig Economy Emerges?

- Flexibility of Work

- Employers can select the greatest talent available for a project without being constrained by geography in the digital era because the worker does not need to sit at a set location.

- Emergence of a start-up culture

- Emerging Start up needs more freelancers than full-time staffs

- To reinforce their digital platforms, start-ups are also looking to hire competent technology freelancers (on a project basis) in fields like engineering, product, data science, and machine learning.

- Contractual Employees are in High Demand

- MNCs are using flexi-hiring options to cut operational costs after the epidemic, especially for specialised projects.

- This trend is playing a big role in India’s gig economy.

- Effect of Pandemic

- According to the survey, the epidemic will result in the loss of 135 million jobs in India, pushing the full-time workers into the gig economy.

- Furthermore, many laid-off workers are focusing on improving their abilities in order to take advantage of freelancing job opportunities and contribute to the growing economy.

Labour Code for the Gig Economy

- Code on Wages 2019

- In both organised and unorganised sectors, including gig workers, the Code on Wages2019 specifies a consistent minimum rate and floor wage.

- Code on social Security, 2020

- In the Code on Social Security, 2020, gig workers are recognised as a new occupational category.

- A gig worker is someone who performs labour or engages in work arrangements outside of the traditional employer-employee relationship and receives money for doing so.

Benefits of the Gig Economy

- Provide for instant demand

- By making labour more responsive to the requirements of the moment and need for flexible lifestyles, the gig economy can benefit workers, firms, and consumers.

- More cost-effective and efficient

- Employers rarely have the financial resources to hire full-time personnel. A substantial number of people work part-time or on a temporary basis in the gig economy.

- For example – Uber , Zomato

- More choice for employers and employees

- Employers

- Technology and internet connectivity eliminate the need for the freelancer to come into the workplace to work.

- As a result, companies have a larger pool of candidates to pick from because they are not limited to hiring someone based on their vicinity.

- Employees

- People frequently find that they must relocate or work numerous jobs in order to finance the lifestyle they desire.

- People nowadays tend to change occupations frequently during their life; the gig economy reflects this growing trend.

- Employers

Disadvantages of Gig Economy

- Insecurity of Work

- There is no predictability, stability, or job security.

- Workers can be fired at any time.

- Workers have little bargaining leverage.

- Financial Insecurity

- Workers do not get pensions, gratuity, perks etc. that are available for full-time workers.

- There is no basis on which banks and other financial service providers can extend lines of credit when steady income is not assured.

- The social welfare objectives can be neglected if business and profitable avenues of freelancing are prioritized.

- Accessibility

- The opportunities under gig economy is not accessible to some people who used to live in rural area where internet connectivity is poor

Pic Courtesy : Mint, India Brand Equity Foundation

Content Source : The Hindu